>>滨州青又称北大青,属花岗岩,质地坚硬,花色统一,板面规范,以深色为主花点装饰,产地和板材加工主要在河北灵寿县,可做各种室外建筑用材,美观好看大方!

河北灵寿华廷石材厂,位于石家庄市灵寿县境内,距离京昆高速灵寿出口1公里,交通便利,我公司是一家集矿山荒料开采,板材生产加工,工程安装施工等为一体的综合型企业,位于河北石材加工聚集地灵寿县,是源头产地厂家直销,主营:滨州青石材、北大青石材、河北黑板材,森林绿,山西黑,贵妃红,浪淘沙等花岗岩,可加工各种板面,磨光面、亚光面、水洗面,火烧面,荔枝面,自然面,拉丝面,剁斧面,龙眼面,仿古面等,拥有丰富矿山荒料资源,查看更多石材,可光临我们工厂实地查看,洽谈合作,共创辉煌,期待与您真诚合作!

2023年,滨州青等河北花岗岩价格行情怎样,一平方市场价有50,80,100,200,主要根据不同工艺和板面报价,且异形加工墓碑石等差价大,所以具体以电话咨询为主!

我公司拥有经验丰富技术团队,先进石材加工设备机械,可根据使用环境场所加工不同花岗岩,承接国内外大小工程订单,园林景观石设计,别墅小区庭院石工程,广场户外草坪石,室内造景石,大型门牌石以及配套雕塑刻字等,详情致电!查看更多>>

在园林景观设计中有比较常用的十大景观石,例如本网站提到的,还有黄石,龟纹石,灵璧石,房山石,石笋石,英石,千层石以及太湖石,你认识它们嘛

2020年很不一般,不知道明天和意外那个先到,对石材厂家来说,也是不平凡的一年,充满了惊险和刺激,那么多少钱一吨呢,主要分为20公分以下以上和大吨位三种!

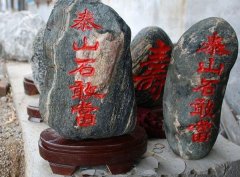

敢当是国务院首批公布的非物质文化遗产,古时候禁忌和崇拜较多,把刻有敢当的石碑放于桥道要冲或房屋墙壁上,有镇压不详之邪作用,那现在放家里好不好呢

产地在河北省定州市、曲阳县、阜平雪浪谷等地,其中曲阳县位于太行山地主脊,石头在曲阳西部山区河谷中,很多城镇都有产,至于哪个村产,可莅临产地查看!

版权所有:河北灵寿华廷石材厂

联系人:安经理 自有加工厂,产地厂家直销,价格优惠,详情致电

可承接国内外大小工程,或根据具体工程异形加工,按需定制定做,墓碑石板,质量好!

花岗岩,岩质坚硬,成色均匀,强度高,抗风化,耐酸碱,耐磨损,吸水性低,色泽美观大方,建筑的好用材!